Understanding Your Compliance Needs

Making Tax Digital requirements vary depending on how you structure your property business. RentalBux provides purpose-built solutions for each structure, ensuring you meet HMRC requirements efficiently while managing your property portfolio effectively.

Individual Landlords & Sole Traders

If you operate as an individual, you'll need to submit quarterly updates and end-of-year declarations to HMRC under MTD for Income Tax Self Assessment. Whether you have property income alone, self-employment income alone, or both streams combined, RentalBux handles your MTD obligations in a single, integrated platform.

Partnerships & LLPs

Property partnerships come with added administrative complexity. Income, expenses, and profit shares must be clearly recorded and allocated between partners, while each individual partner remains responsible for their own tax reporting. RentalBux helps by organising partnership records, tracking agreed profit splits, and giving each partner clear visibility over their share - reducing confusion and making year-end reporting far simpler.

Limited Companies

Landlords operating through limited companies have different financial reporting and tax considerations compared to individual landlords. This typically includes company-level income tracking, expense management, and preparing information needed for corporation tax reporting. RentalBux supports limited company property portfolios by organising rental income and costs in one place, giving directors and accountants clear, structured records to work from at year end.

What's Included Across All Plans

Regardless of which plan you choose, you'll have access to RentalBux's comprehensive property accounting platform. These aren't "basic" features – they're the sophisticated tools that make RentalBux the MTD solution built specifically for property businesses.

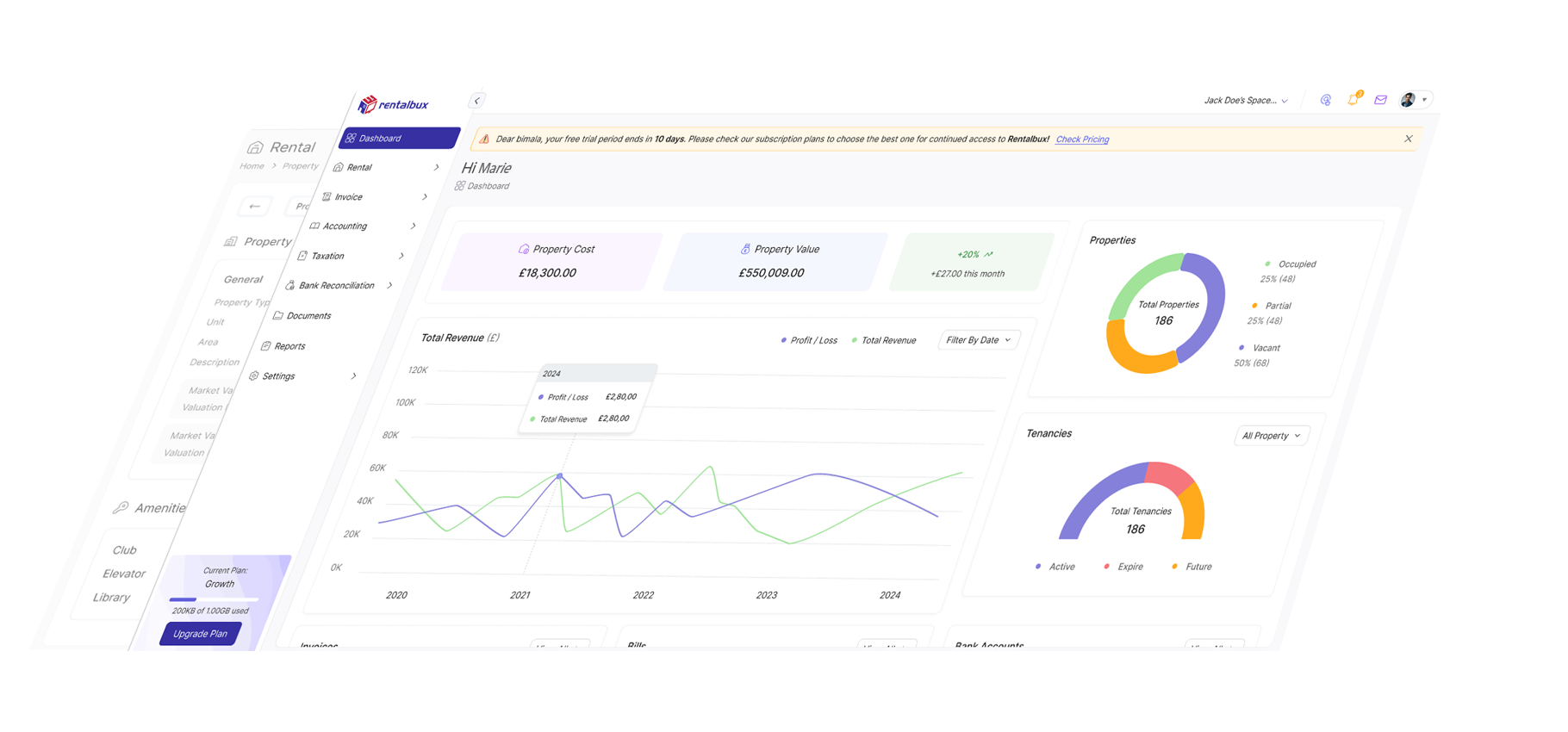

Intelligent Property Accounting

Track income and expenses at the property level, not just as general categories. See profit and loss for individual properties, portfolios, or your entire business. Understand which properties perform best and where costs are increasing.

Bank Feed Automation & Receipt Capture

Connect your bank accounts for automatic transaction imports. Snap photos of receipts with your phone. Let RentalBux's AI categorise transactions correctly based on property tax rules, saving hours of manual data entry each month.

Letting Agent Statement Import

Upload statements from your letting agent, and RentalBux automatically extracts rent received, management fees, and other charges. No more manual re-entry of data you already have elsewhere.

MTD Quarterly Submission

Generate and submit your MTD quarterly updates to HMRC directly from RentalBux. Review your figures, confirm accuracy, and file with confidence. The software handles all the technical HMRC integration automatically.

Foreign Property Income Reporting

If you own property abroad, RentalBux is HMRC-recognised for reporting foreign property income under MTD. Track foreign income, claim foreign tax credits, and meet your UK tax obligations for overseas property.

Joint Ownership & Profit Sharing

Own property jointly with a spouse, business partner, or family member? RentalBux handles split ownership properly, allocating income and expenses based on ownership percentages and enabling separate MTD submissions for shared property records.

Tenancy Management & Compliance Tracking

Record tenancy details, track lease terms, and set reminders for critical compliance dates. Never miss an EPC renewal, gas safety certificate, or insurance renewal again.

Document Storage & Organisation

Store all property-related documents securely in the cloud. Invoices, certificates, tenancy agreements, and correspondence – everything in one place, accessible whenever you need it, especially during an HMRC enquiry.

Choosing the Right Plan for Your Business

Select your business structure below to see detailed information about how RentalBux supports your specific needs.

Who is this for?

Landlords with one or multiple properties generating rental income above £20,000 annually. Self-employed tradespeople who also own rental property. Property investors managing portfolios alongside other business activities. Anyone with "hybrid income" who needs one platform for both streams.

What makes this different?

General accounting software treats property as an afterthought. RentalBux treats property as a first-class workflow. The software understands landlord-specific tax rules: Section 24 restrictions, repairs vs improvements, rent-a-room relief, and replacement domestic items relief.

Why one platform for hybrid income matters

Under MTD, landlords with self-employment income must submit eight quarterly updates per year – four for property and four for self-employment. Managing this across two systems is inefficient and risks missing deadlines. RentalBux combines both in one subscription.

Who is this for?

Property investment partnerships where two or more individuals jointly own a portfolio. Family investment LLPs managing inherited or accumulated property. Professional property partnerships with allocated profit shares.

What makes partnership accounting complex?

Each partner has their own obligations, but those obligations depend on accurate partnership record-keeping. Changes in profit allocation, capital contributions, or drawings affect multiple people's tax positions. Get the partnership accounts wrong, and every partner's accounts is incorrect.

How RentalBux handles partnerships

Central partnership records track all income and expenses at the property level. Profit allocation rules distribute partnership profits among individual partners in accordance with the agreement terms. Each partner can access their allocated share. Changes cascade through the system automatically.

Who is this for?

Limited companies whose primary business is property investment and rental. Corporate structures with multiple properties require proper accounting records. Property businesses that have incorporated for tax planning purposes. Companies requiring Corporation Tax computation.

Why property companies need specialised software

A property investment company isn't like other businesses. There's no "cost of goods sold" or inventory. Revenue is rental income, expenses follow property tax rules, and capital expenditure treatment differs from that of trading companies. Generic accounting software doesn't reflect the economic reality of property investment.

What RentalBux handles for limited companies

Full double-entry accounting tailored for property businesses. Corporation Tax calculations specific to rental income and property disposals. Dividend planning and director's loan account management. Annual accounts preparation is ready for Companies House filing.

Why Property Businesses Choose RentalBux

Most accounting software was designed for trading businesses: buying inventory, selling products, managing cash flow. Property investment works differently. You're not selling anything. You're holding assets that generate rental income while incurring specific property-related expenses under specific tax rules.

Property Tax Rules Built In

RentalBux knows that mortgage interest is restricted under Section 24. It knows that repairs are revenue expenses, but improvements are capital. It knows that furniture in a residential letting qualifies for replacement domestic items relief, but furniture in a commercial letting doesn't. This knowledge is embedded in the software, protecting you from expensive mistakes.

Portfolio-Level Insights

See profit and loss for individual properties, compare performance across your portfolio, identify which properties are most profitable and which are dragging down returns. Understand your business in a way that generic accounting software can't show you.

HMRC Integration That Works

We're HMRC-recognised software for MTD. Every quarterly submission is tested against HMRC's requirements. Foreign property reporting, multiple income streams, joint ownership – we handle scenarios that other software fumbles.

Built by Property Accountants

RentalBux was created by the team at UK Property Accountants, specialists who prepare tax returns for over 1,000 landlords. We built this software because we got tired of fighting with generic accounting tools that didn't understand property taxation. We built what we needed, and now we're sharing it with you.

From Sign-Up to MTD Compliance in Three Steps

Choose Your Plan & Start Free

Select the plan that matches your business structure. Start free with immediate access to all features. No credit card required to begin.

Add Your Properties & Historical Data

Add your property portfolio to RentalBux. Import past transactions from spreadsheets or previous accounting software. Connect your bank feeds for ongoing automation. Upload letting agent statements if applicable. Our onboarding wizard guides you through each step.

Authorise HMRC Connection & Submit First Update

Connect RentalBux to HMRC through their secure authorisation process. Review your first quarterly update. Submit directly to HMRC from within the software. You're now MTD compliant.