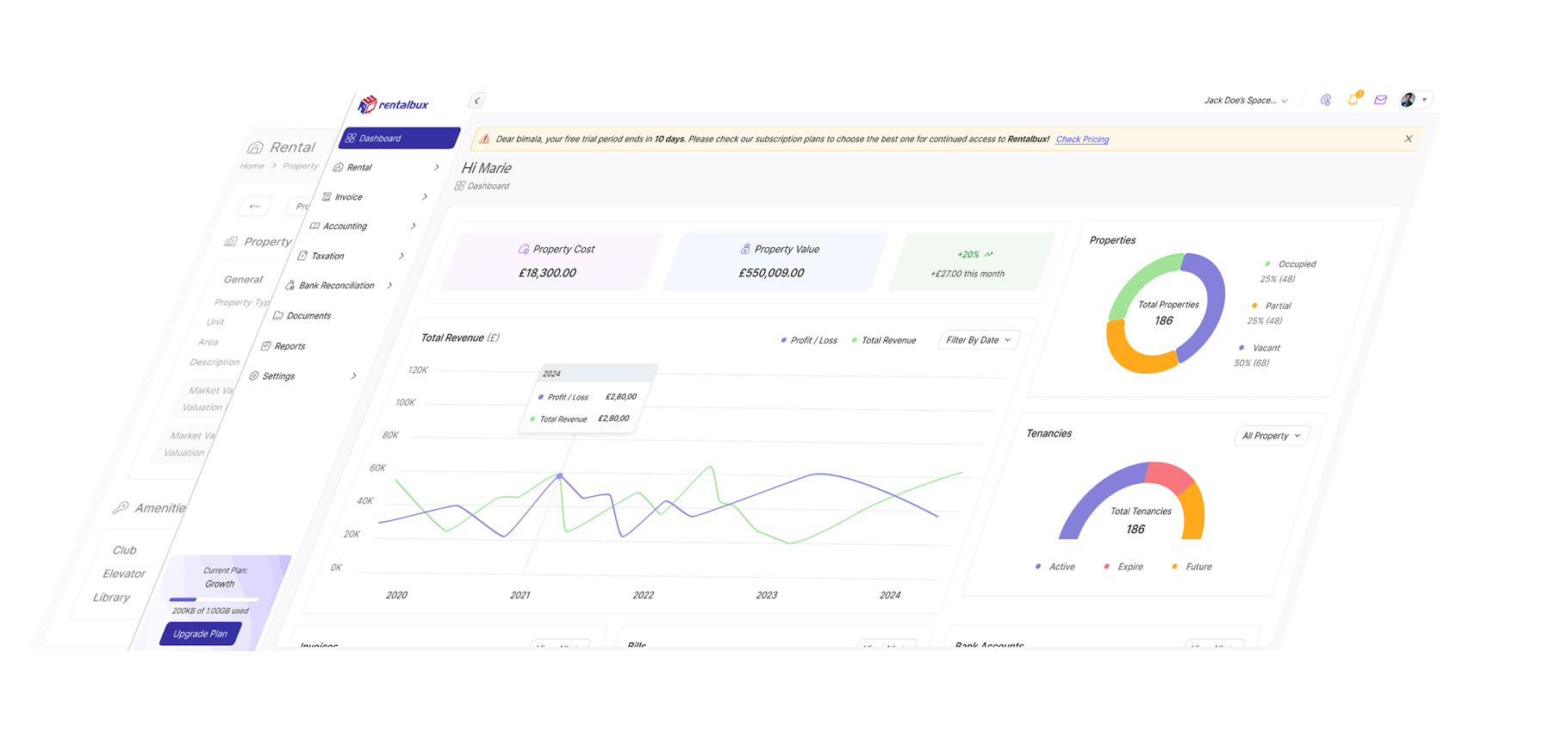

Making Tax Digital (MTD) Software for Landlords. Submit Quarterly, Stay Compliant.

Submit MTD in minutes not hours. Track every property. All from one dashboard.

RentalBux is a software for Making Tax Digital for Income Tax Self-Assessment (MTD ITSA) built specifically for landlords – whether you have UK or Foreign property or even self-employed income. No accounting jargon. No ongoing bookkeeper fees. No spreadsheets. No Stress.

"I was dreading Making Tax Digital. I assumed I'd need to hire a bookkeeper or wrestle with complicated accounting software to stay MTD compliant. RentalBux made it surprisingly straightforward not only MTD but also managing my property business. Surprisingly, it tracks my properties, tenancies and mortgages and provides me properly level profit & loss on top of MTD filing"

Robert H.

What Our Other Users Say

"Running a trade business and managing rental properties used to mean two software subscriptions and hours of manual work. RentalBux handles both perfectly—one platform, one price, everything organised."

- James T., Builder & Landlord

"As a consultant with rental properties, I love having separate profit reports for each business. It's so clear which income stream performs better, and the combined MTD submission is seamless."

- Emma L., Consultant & Property Investor

4.9/5

Average Rating in Trustindex

The Two Problems Landlords Face with

MTD Property Income

Most landlords hit one of two obstacles:

RentalBux solves both. It's landlord MTD software that combines property management, digital record keeping for landlords, and

quarterly MTD submissions in one platform—without the bookkeeper fees.

How MTD Compliance Works for Rental Property—Built for How Landlords Actually Operate

RentalBux handles Making Tax Digital the way landlords manage properties: simple, property-by-property tracking, automatic calculations, and straightforward HMRC submissions, all in one easy MTD software for landlords.

Is MTD Software for Landlords Mandatory? Here's What HMRC Requires—And How RentalBux Delivers

RentalBux handles the key MTD requirements HMRC mandates—without the complexity of business accounting software. This MTD software for landlords streamlines rental income and expense management, ensuring full Making Tax Digital compliance.

Digital Record Keeping for Landlords (HMRC-Compliant)

Every rental transaction is stored digitally as HMRC requires. Bank feeds import rent payments automatically. Scan invoices and receipts with your phone—plumber bills, agent fees, insurance renewals—and RentalBux stores them digitally against the correct property.

One-Click MTD Submission to HMRC

Submit quarterly updates directly to HMRC through RentalBux. Our software is fully MTD-compatible and handles the technical submission process. You review figures, confirm accuracy, and submit. HMRC receives your update instantly, and you get confirmation on-screen.

MTD for UK & Foreign Property Income

Own property abroad? RentalBux tracks UK and foreign rental income separately as HMRC requires. Submit MTD returns covering both domestic and overseas properties—correctly categorised, properly reported for Making Tax Digital compliance.

Automatic Quarterly MTD Calculations for Rental Income

RentalBux calculates your quarterly rental income and allowable expenses automatically—no spreadsheets, no manual adding. View figures property-by-property or for your entire portfolio, ready for quarterly submission to HMRC with the help of MTD software for landlords.

MTD Deadline Reminders & Submission History

Never miss a quarterly MTD deadline. RentalBux tracks submission dates based on your tax year and sends reminders before each due date. View complete submission history—what you submitted, when, and HMRC confirmation.

Property-Specific Expense Categories for Landlords

Unlike generic accounting software, RentalBux understands landlord expenses. Categorise transactions correctly the first time: repairs vs improvements, allowable vs non-allowable, Section 24 mortgage interest, furnished property allowances - all seamlessly managed with MTD software for landlords.

MTD Compliance for UK Landlords—From First Property to Large Portfolio

Yes, MTD is mandatory for rental income over £50,000 from April 2026. Making Tax Digital software for landlords like RentalBux works at every stage who need to meet Making Tax Digital requirements.

Landlords Approaching the £50k MTD Threshold

New to property investing or approaching the MTD threshold? RentalBux guides you through setup, keeps digital records automatically, and makes quarterly submissions straightforward from day one.

Portfolio Landlords Managing Multiple Properties

Own multiple rental properties? RentalBux tracks income and expenses property-by-property, calculates quarterly figures for your entire portfolio, and submits consolidated MTD returns covering all properties. No manual consolidation, no duplicate data entry.

Landlords with Self-Employment Income

Earn rental income and self-employment income? RentalBux handles MTD for both income streams in one platform—submit Property Income and Self-Employment quarterly updates without separate systems. MTD software for landlords makes this process simple and efficient.

Joint Property Owners

Own property jointly with a spouse, partner, or business associate? RentalBux automatically splits rental income and expenses based on ownership percentages, ensuring both co-owners submit accurate quarterly updates with MTD software for landlords.

HMO Landlords

Rent out properties with multiple tenants? RentalBux tracks income from all tenants, calculates quarterly figures, and handles MTD submissions for HMO properties.

Commercial Property Landlords

Own commercial rental properties? RentalBux handles MTD for commercial rentals with the same straightforward process as residential properties.

Landlords Working with Accountants

Your accountant handles year-end tax returns, but you want to manage quarterly MTD submissions yourself? RentalBux gives your accountant access to review figures and submit on your behalf when needed.

How RentalBux Compares to Other MTD Software for Landlords

See why landlords choose RentalBux over spreadsheets and other generic MTD software.

| Feature | Spreadsheets | Generic MTD Software | RentalBux |

|---|---|---|---|

| Built for Landlords |

No

|

No

|

Yes

|

| MTD Compliant |

No

|

Yes

|

Yes

|

| Joint Ownership Profit Split |

No

|

No

|

Automatic

|

| Quarterly MTD Calculations |

Manual

|

Basic

|

Automatic

|

| Foreign Property MTD |

Manual

|

No

|

Yes

|

| Pre-Built Landlord Specific Accounts |

Manual Setup

|

Generic

|

Yes

|

| MTD Deadline Reminders |

No

|

Basic

|

Yes

|

| Accountant Collaboration |

Complex

|

Limited

|

Yes

|

Start Free - See the Difference Yourself

Experience the power of MTD-compliant software built specifically for landlords. No credit card required.

Get Started FreeFAQ: Frequently Asked Questions About MTD for Rental Property

Answers to the most common questions UK landlords have about Making Tax Digital compliance.

When does MTD start for landlords?

MTD for Income Tax Self Assessment starts April 2026 for landlords with rental income over £50,000. Landlords with income over £30,000 will follow from April 2027.

Is RentalBux fully MTD compliant?

Yes. RentalBux meets all HMRC requirements for Making Tax Digital for Income Tax Self Assessment. You can keep digital records, calculate quarterly income and expenses, and submit updates directly to HMRC through our MTD software for landlords, which is HMRC-recognised.

Do landlords need MTD software?

Yes. HMRC requires landlords to use MTD-compatible software that can maintain digital records and submit quarterly updates directly to HMRC systems. Spreadsheets alone are not MTD compliant.

How do landlords submit MTD returns?

With RentalBux, quarterly submissions are simple: the software calculates your rental income and allowable expenses automatically. You review the figures, confirm they're correct, and submit to HMRC with a few clicks. RentalBux handles the technical submission process using Making Tax Digital software for landlords.

Do I need accounting experience for MTD compliance?

No. RentalBux is designed for landlords, not accountants. The interface guides you through recording income and expenses, calculates quarterly figures automatically, and makes submissions straightforward—no accounting knowledge required.

Can RentalBux handle MTD for multiple properties?

Yes. RentalBux tracks income and expenses property-by-property, calculates quarterly figures for your entire portfolio, and submits consolidated MTD returns to HMRC covering all your rental properties.